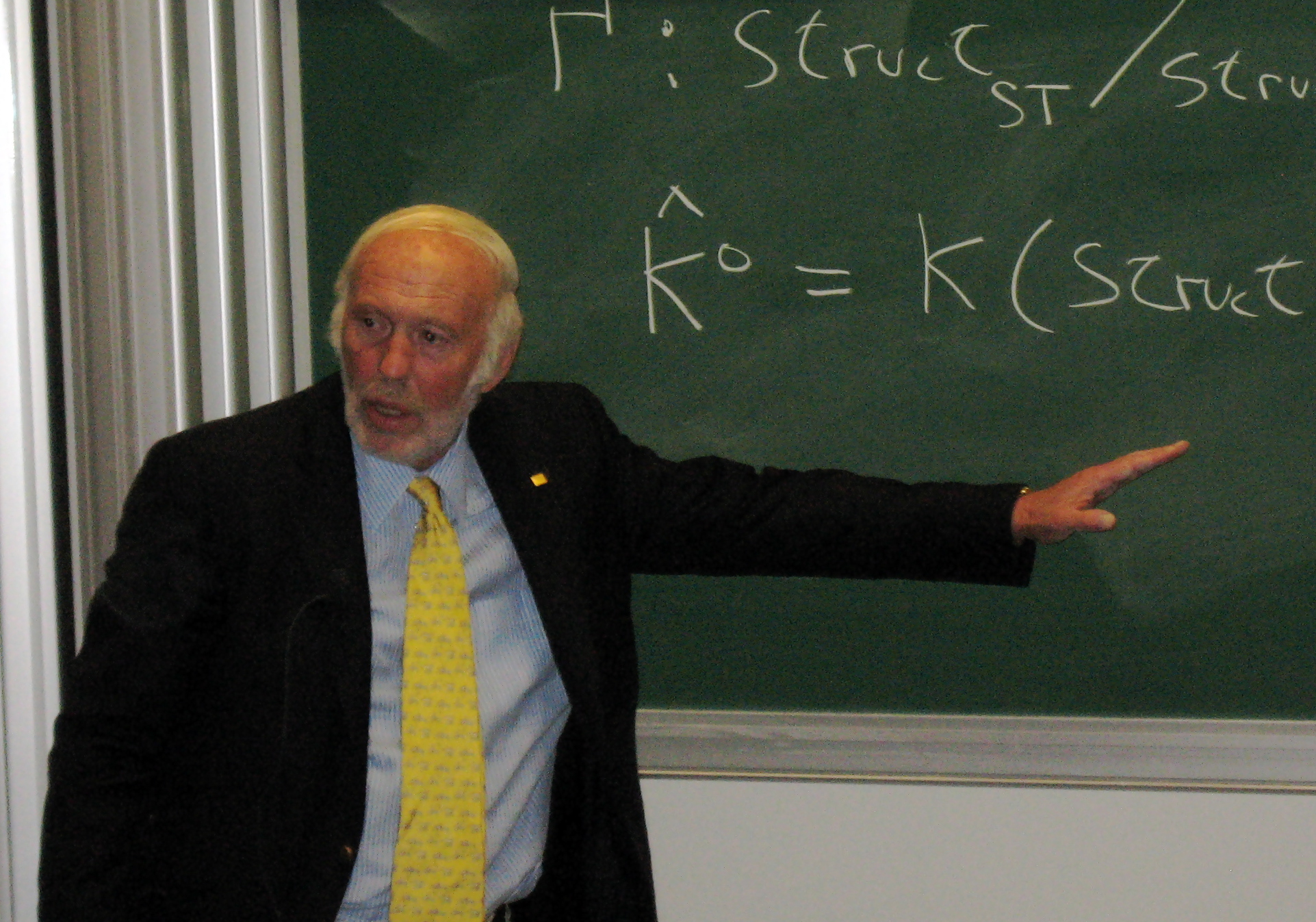

The Legacy of Jim Simons: A Math Genius Who Conquered Wall Street

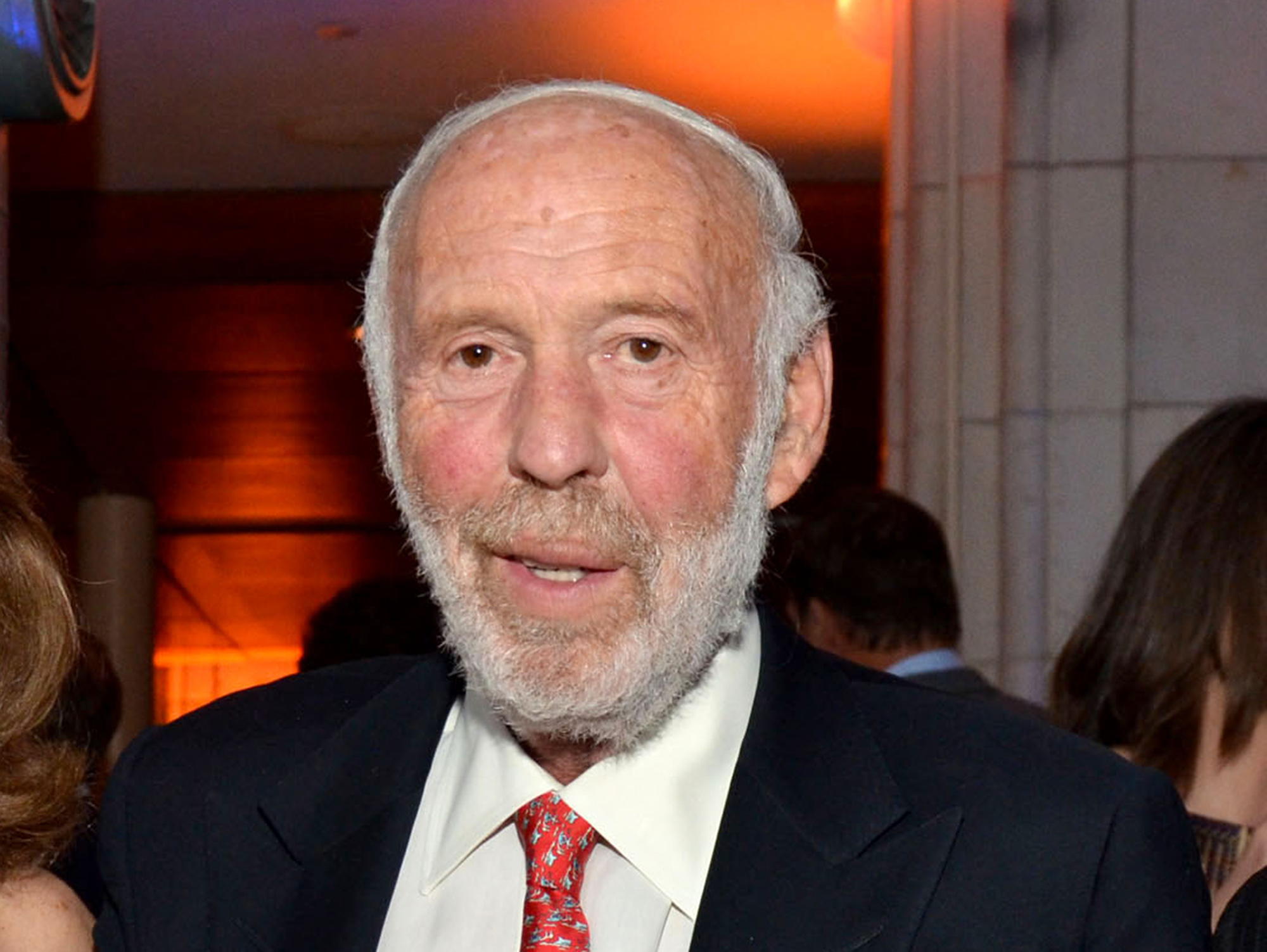

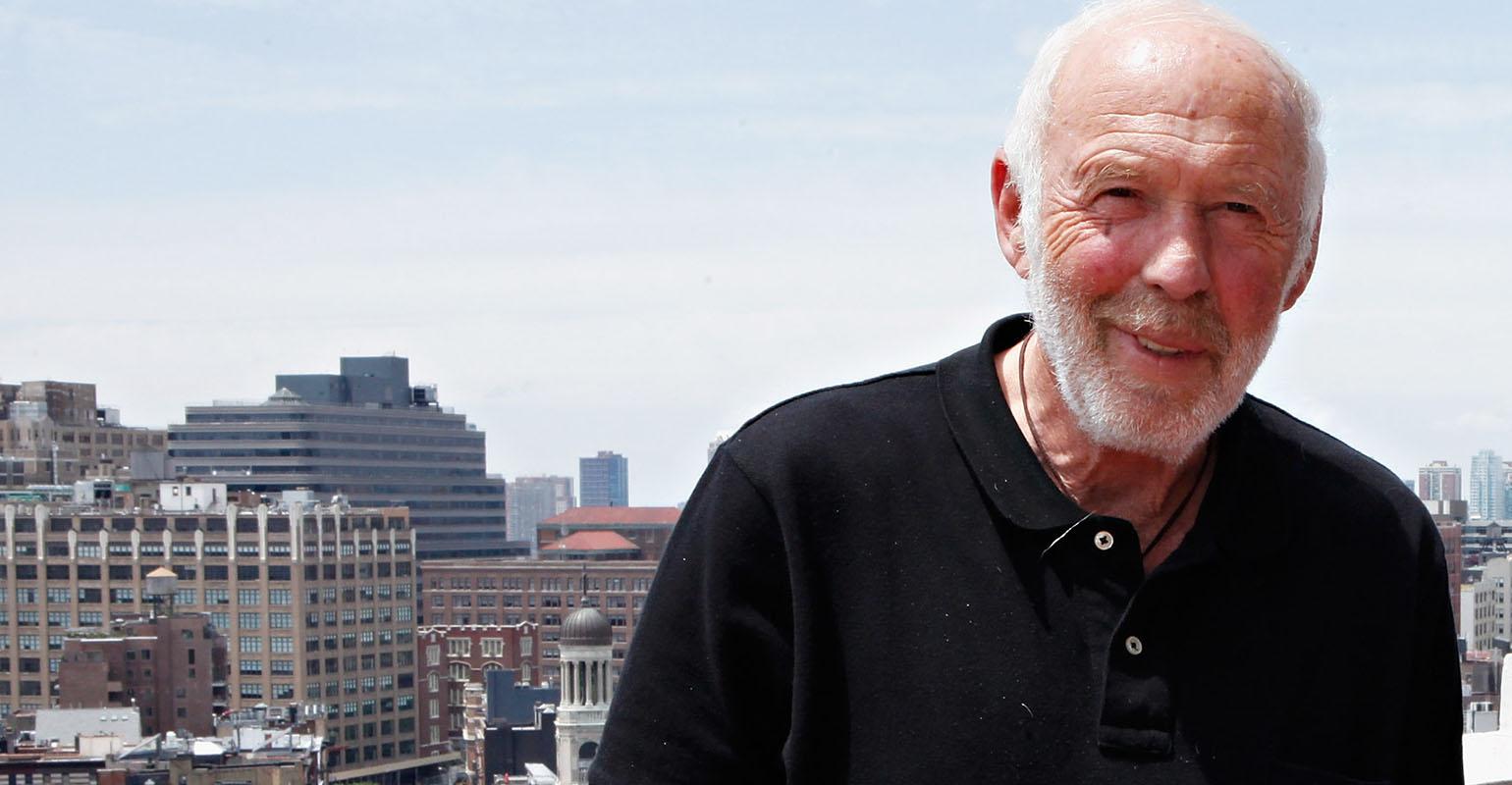

James Harris Simons, the renowned mathematician, hedge fund manager, and philanthropist, passed away on May 10, 2024, at the age of 86. His legacy, however, will live on as a pioneer in quantitative investing and a brilliant mind who revolutionized the world of finance.

A Mathematician Turned Billionaire

Simons' journey from academia to the world of finance was nothing short of remarkable. He founded Renaissance Technologies, a quantitative hedge fund that used mathematical models and algorithms to make investment gains from market inefficiencies. His Medallion Fund had an average annual return of 66% over decades, making him one of the most successful hedge fund managers of all time.

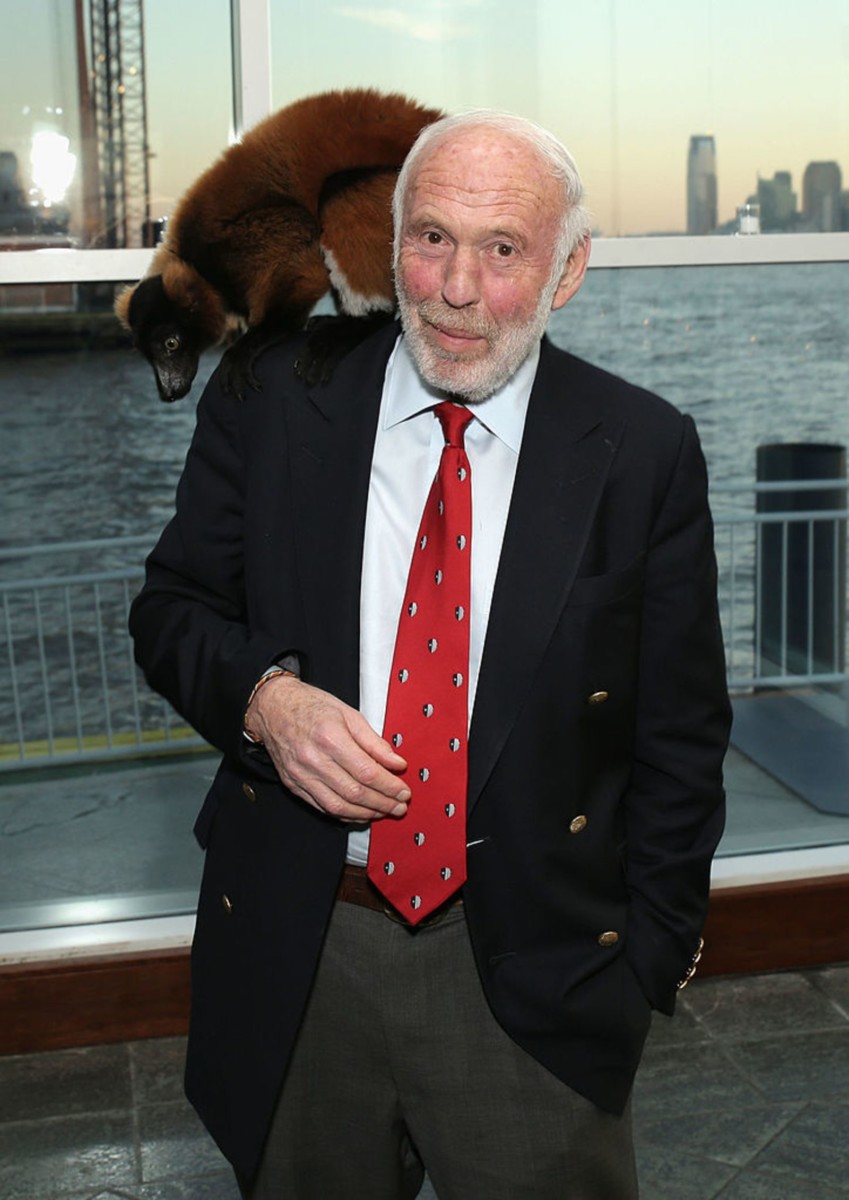

A Philanthropist and Visionary

Simons was not only a brilliant mathematician but also a generous philanthropist. He founded the Simons Foundation, which supports research and education in mathematics and science. His legacy will continue to inspire and support future generations of researchers and mathematicians.

Through his work, Simons proved that mathematical models could be applied to the world of finance, pioneering the field of quantitative investing. His Jim Simons strategy, which relied on complex algorithms and data analysis, was a game-changer in the world of finance.

A Lasting Legacy

Jim Simons may be gone, but his impact on the world of finance and mathematics will be felt for generations to come. His legacy serves as a reminder that with determination, hard work, and a passion for learning, anyone can achieve greatness.

Category: #Business

/GettyImages-485151711-b01a35f819334cadb1645c18d3a30ed0.jpg)

![Jim Simons Net Worth: Career, Lifestyle & Charity [2024 Update] Jim Simons Jim Simons Net Worth: Career, Lifestyle & Charity [2024 Update]](https://wealthypeeps.com/wp-content/uploads/2022/07/JimSimonsFeatured-1160x773.jpg)

/https:%2F%2Fspecials-images.forbesimg.com%2Fimageserve%2F5dc439fab4d5050007a51037%2F0x0.jpg%3Ffit%3Dscale)

![Jim Simons Net Worth: Career, Lifestyle & Charity [2024 Update] Jim Simons Jim Simons Net Worth: Career, Lifestyle & Charity [2024 Update]](https://wealthypeeps.com/wp-content/uploads/2022/06/JimSimons-1162x1536.jpg)

![Jim Simons Net Worth: Career, Lifestyle & Charity [2024 Update] Jim Simons Jim Simons Net Worth: Career, Lifestyle & Charity [2024 Update]](https://wealthypeeps.com/wp-content/uploads/2022/06/JimSimons-775x1024.jpg)

![Jim Simons Net Worth: Career, Lifestyle & Charity [2023 Update] Jim Simons Jim Simons Net Worth: Career, Lifestyle & Charity [2023 Update]](https://wealthypeeps.com/wp-content/uploads/2022/06/JimSimons-1160x1533.jpg)