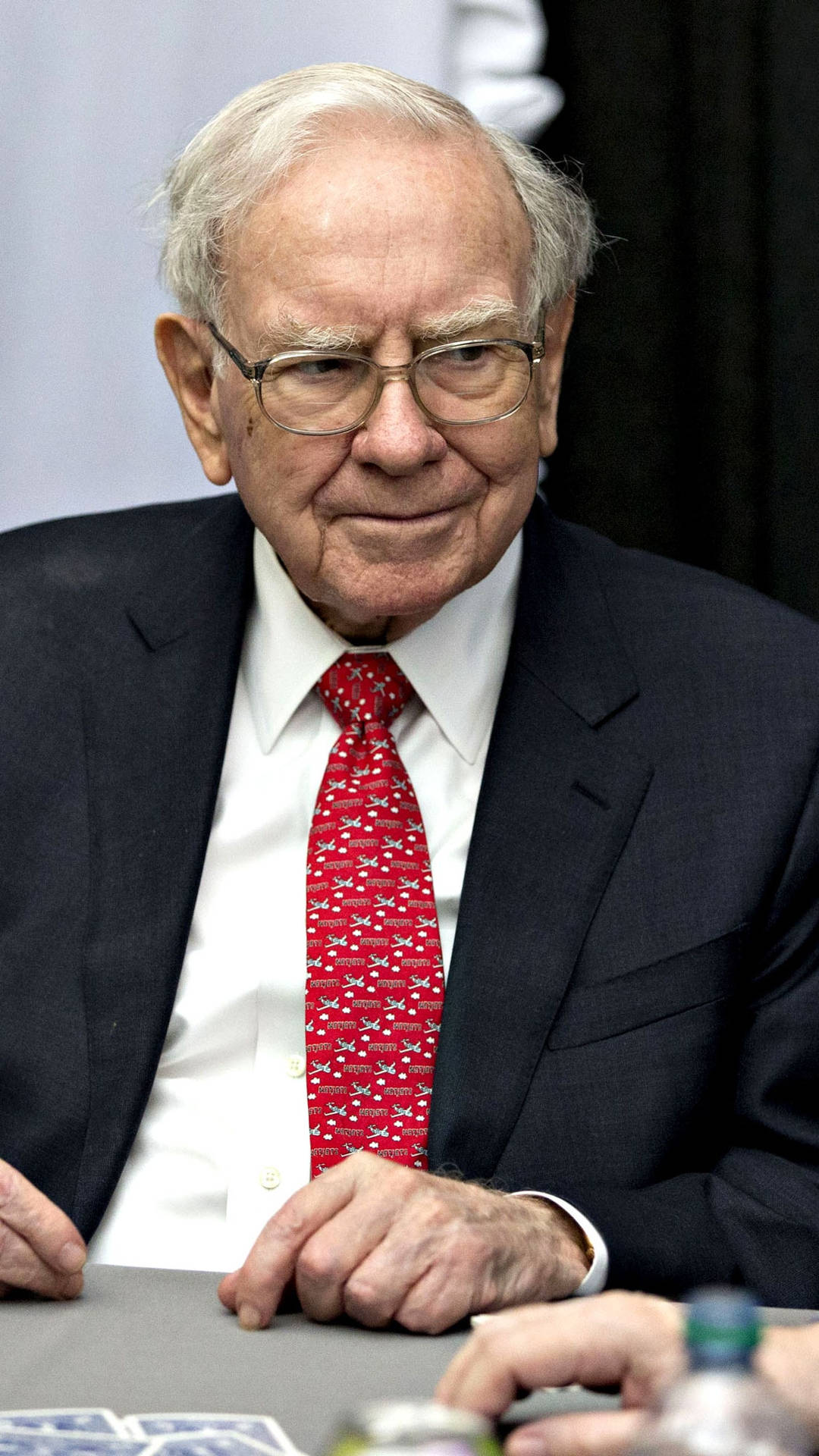

The Enduring Wisdom of Warren Buffett: Insights from the Oracle of Omaha

Warren Buffett: A Legendary Investor and Philanthropist

Warren Buffett, the "Oracle of Omaha," is a name synonymous with investment prowess and financial acumen. Born in 1930, this self-made billionaire has amassed a fortune through his value investing strategy and astute business decisions. As the co-founder, chairman, and CEO of Berkshire Hathaway, Buffett has transformed the company into a global conglomerate with a diverse portfolio spanning various industries.

Warren Buffett's Investment Philosophy

Buffett's investment philosophy revolves around identifying undervalued companies with strong fundamentals and holding them for the long term. His patient and disciplined approach has yielded remarkable returns, making him one of the most successful investors in history. Buffett's portfolio includes stakes in tech giants like Apple and Microsoft, as well as a diverse range of companies across various sectors.

Warren Buffett's Quotes: Timeless Wisdom

Throughout his illustrious career, Buffett has shared countless insights and quotes that have become guiding principles for investors worldwide. From emphasizing the importance of patience and discipline to advocating for ethical business practices, his words resonate with both seasoned professionals and aspiring investors alike.

"Rule No. 1: Never lose money. Rule No. 2: Never forget rule No. 1."

This famous quote encapsulates Buffett's risk-averse approach to investing, emphasizing the importance of preserving capital and avoiding unnecessary losses.

"It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price."

Buffett's focus on quality over bargain hunting highlights his belief in investing in companies with strong fundamentals and sustainable competitive advantages.

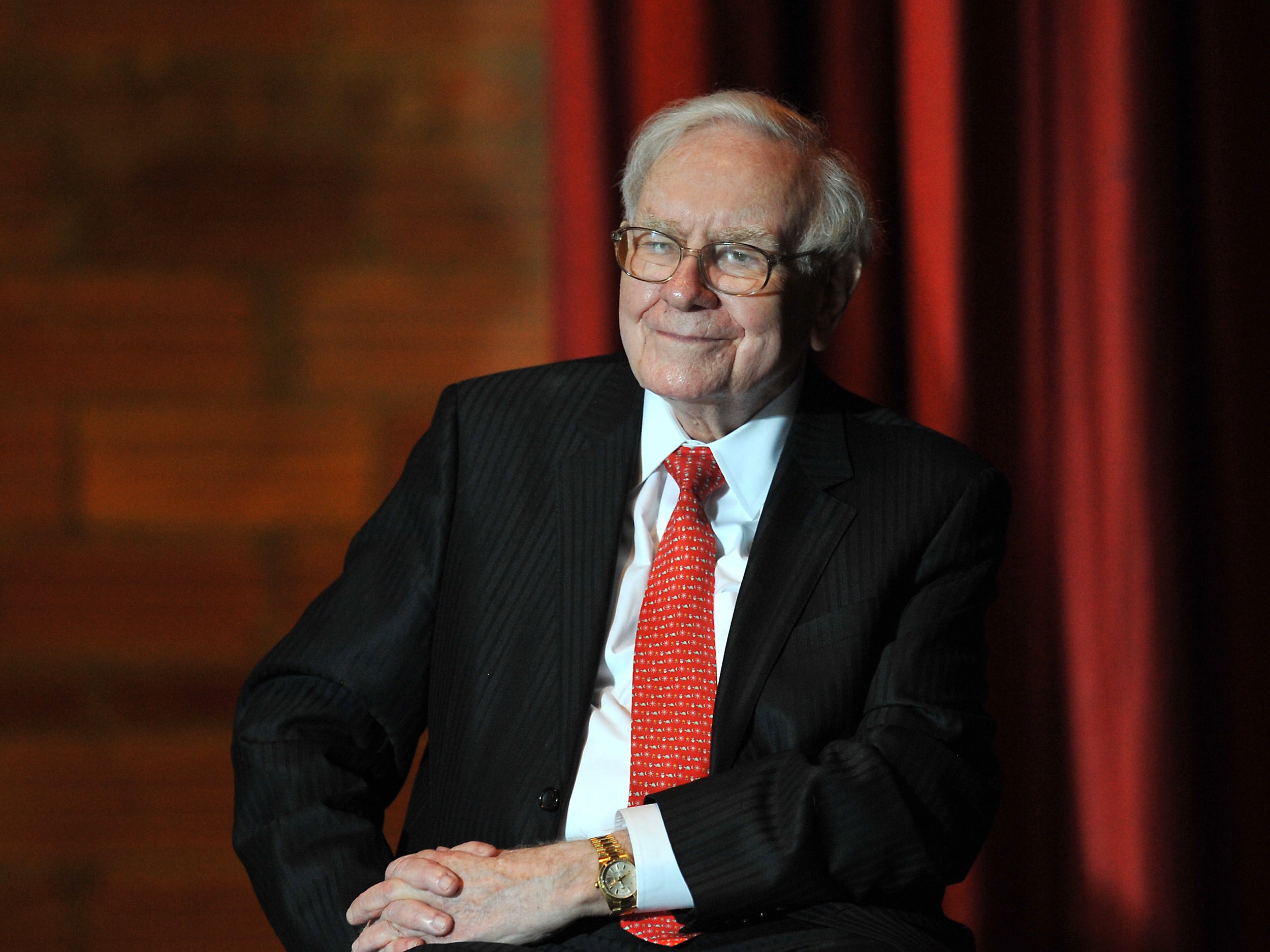

Warren Buffett's Philanthropic Endeavors

Beyond his investment prowess, Buffett is also renowned for his philanthropic efforts. In 2006, he pledged to donate the majority of his wealth to charitable causes, primarily the Bill & Melinda Gates Foundation. This commitment to giving back has inspired others to follow suit, cementing Buffett's legacy as a visionary investor and humanitarian.

The Enduring Legacy of Warren Buffett

As Warren Buffett approaches his 90s, his influence on the investment world remains unparalleled. His books, speeches, and annual letters to Berkshire Hathaway shareholders continue to inspire and educate generations of investors. With his unwavering commitment to value investing and ethical business practices, Buffett's legacy will undoubtedly endure as a beacon of wisdom in the ever-evolving financial landscape.