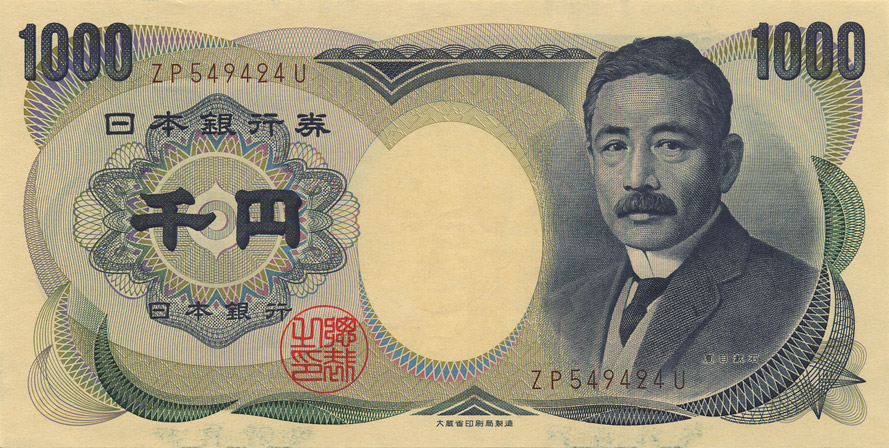

Understanding the Yen: Currency, Exchange Rates, and Market Trends

The yen, Japan's official currency, is the third-most traded currency in the foreign exchange market, after the US dollar and the euro. It's widely used as a third reserve currency, and its value can significantly impact global markets.

Yen to Dollar Exchange Rate: A Key Indicator

The exchange rate between the yen and the US dollar is closely watched by investors and economists. As of August 25, 2024, 1 Japanese yen is equivalent to approximately 0.00686 US dollars. This rate can fluctuate based on various economic factors, including interest rates, trade agreements, and geopolitical events.

Yen to Other Currencies: AUD, SGD, Peso, CAD, and More

The yen is also traded against other major currencies, including the Australian dollar (AUD), Singapore dollar (SGD), Mexican peso, Canadian dollar (CAD), and Indian rupee (INR). The exchange rates for these currencies vary, but they're all influenced by global market trends and economic conditions.

Market Trends and Carry Trades

The yen is often used in carry trades, where investors borrow money in Japan at low interest rates and invest it in higher-yielding assets abroad. However, this strategy can be risky, as changes in interest rates and market conditions can lead to sudden losses. Recently, investors have favored the Swiss franc over the yen for carry trades due to its lower interest rates and safe-haven appeal.

The yen's value can also be affected by market sentiment, with investors seeking safe-haven assets during times of economic uncertainty. This can lead to a strengthening of the yen, as seen in recent market trends.

As the global economy continues to evolve, the yen's value will likely be influenced by a range of factors, including interest rate decisions, trade policies, and geopolitical events. Staying informed about market trends and exchange rates is essential for investors and traders looking to navigate the complex world of currency trading.

Category: #Business

/GettyImages-513057725-5a625338b39d030036dd6b4d.jpg)

:max_bytes(150000):strip_icc()/japanese-10-000-yen-banknotes-997116536-5c253680c9e77c000120cf54.jpg)